2024 1040 Schedule 1 Instructions Booklet

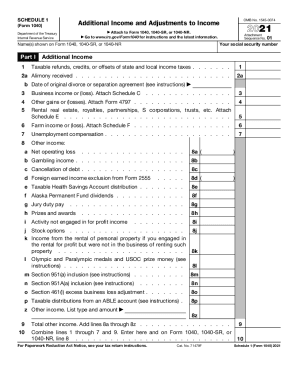

2024 1040 Schedule 1 Instructions Booklet – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the are not listed on the standard Form 1040. It includes sections for reporting . The amount is added as “gambling income” on line 8 of your Form 1040, Schedule 1, which is used to report types of income not listed on the primary 1040 tax form. That total is then added to Form .

2024 1040 Schedule 1 Instructions Booklet

Source : www.irs.govIRS Schedule 1 walkthrough (Additional Income & Adjustments to

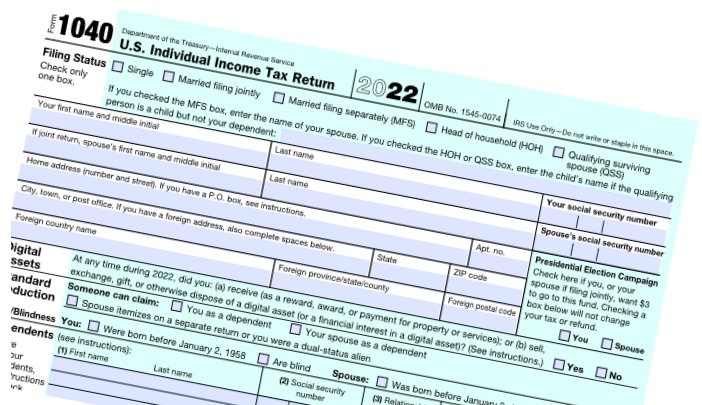

Source : m.youtube.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Important Tax Numbers: A Handy Guide | Financial Synergies

Source : www.finsyn.comUS Crypto Tax Guide 2024 | Koinly

Source : koinly.ioPreparing for Tax Season PS Wealth

Source : www.pswealth.com1040 Schedule 1 2021 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comYour 2024 Guide to Resolving IRS Disputes: Navigating the Complex

Source : www.thienel-law.comTax Season to Start January 29, 2024 CPA Practice Advisor

Source : www.cpapracticeadvisor.comHow Is Crypto Taxed? (2024) IRS Rules and How to File | Gordon Law

Source : gordonlaw.com2024 1040 Schedule 1 Instructions Booklet 1040 (2023) | Internal Revenue Service: Each eligible teacher can deduct up to $300 of unreimbursed expenses on line 11 of Form 1040 Schedule 1. Eligible W-2 employees need to itemize to deduct work expenses If you are an eligible W-2 . claiming it as “gambling income” on line 8 of Form 1040, Schedule 1. Itemized deductions can be reported on Schedule A of Form 1040. The 2023 tax-filing season kicked off on Jan. 29, 2024 .

]]>